I lost all respect for YOU Sup Ct Justice Nominee Jackson, from the point you can’t define the word “Woman.”

Yes, I said YOUR name above because “there is a special place in hell for Women who don’t Support other Women.” Quote by Madeline Albright

I lost all respect for YOU Sup Ct Justice Nominee Jackson, from the point you can’t define the word “Woman.”

Yes, I said YOUR name above because “there is a special place in hell for Women who don’t Support other Women.” Quote by Madeline Albright

View Pelosi and other Members of Congress who Invested in Facebook according to Dirty – “Open Secrets:”

CLICK ON IMAGE or visit opensecrets.org/orgs/facebook-inc/members-invested?id=D000033563

Moffatt Media, Palmdale, California

Friday’s Public Concern: Did you know the U.S. DOJ prosecuted and sentenced a man for ... “Price Gouging Facemasks?”

ALBANY, NEW YORK – Imran Selcuk, age 35, of Troy, New York, was sentenced September 2, 2021, 3 years of probation for … price gouging in violation of the Defense Production Act of 1950 (DPA), said in part by the United States Department of Justice – The United States Attorney’s Office Northern District of New York.

Arend Mathijssen, Quartz Hill, California Concerned Citizen and Taxpayer, reported March 10, 2022, within his own community, cost for Supreme Gas: $6.35 and Diesel $6.79.

Yet, certain Congressional Representatives are blaming “Putin,” for higher Gas prices throughout our Nation.These same Congressional Representatives won’t call out, tell the truth or prosecute big oil and gas companies that are “Price Gouging” Gas, against its own Citizens, similar to the Troy Businessman prosecuted for“Price Gouging Facemasks.” …

Truth Exposed about certain career Congressional Representatives, who are unfriendly towards the same American Citizen’s they claim to represent. But remember the power to vote is one of your most important sacred rights of “We the People, We the Taxpayers and We the Majority!”

###

March 4, 2022, Friday 2:01pm

Moffatt Media, Palmdale, California

2008 Britney Spears, Fannie Mae and Freddie Mac, were appointed Conservators, by State Court and the Federal Government.

Did you know Conservators can be appointed on either a State or Federal level?

Thus, did you also know Spears, Fannie Mae and Freddie Mac, their 2008 conservatorships were only to be “Temporary.”

Amazingly, how the government can redefine simple words such as: “Temporary.” Webster’s Dictionary defines the word “Temporary,” to mean one serving for a limited time.

Reasonably minded people that comprehend the word “Temporary,” would not interpret close to 15 years conservatorship as “Temporary.”

Did you know Conservator Federal FHFA governmental agency has been sweeping profits and entitled Dividend Income of Retirees, since 2008 into the U.S. Treasury?

What has happened to Britney Spears, Fannie Mae and Freddie Mac, can happen to any person or business regardless of its size because it’s all in how government employees create a narrative against you, your business and will take over your person or business if they want to control or steal it.

Now close your eyes and imagine the Federal government Taking over your business without good cause. Imagine being in the shoes of private corporations like Fannie and Freddie, where the government does a transfer (sweeping) into the Federal U.S. Treasury of all your Profits, for 15 years and no sight of ending.

Spears was placed into Court Appointed Conservatorship, Fannie Mae and Freddie were placed into Government Appointed Conservatorship. Finally, approximately in November 2021, Spears was released from Superior Court of California Los Angeles County Conservatorship, which lasted almost 15 years.

Fannie Mae and Freddie Mac, however, are still under supposed “Temporary” Conservatorship from 2008, nearing 15 years.

Top to bottom leadership has a trickle-down effect upon even persons like Britney Spears, other American Citizens and Corporations.

Former President Bush, introduced Federal Conservatorship over Fannie Mae and Freddie Mac Mortgage Corporation giants by creating FHFA, without declaring a National Emergency, in 2008. To date Fannie and Freddie continue suffering a constant Takeover of their private corporations by the Federal government.

Furthermore, the Federal FHFA agency, which was created by the Housing and Economic Recovery Act (HERA) of 2008 to oversee Fannie Mae and Freddie Mac, “Oversee” a nicely semantic word. The Taking over Fannie Mae and Freddie Mac, was not justified through a declared National Emergency. More importantly, the newly created federal agency FHFA was assigned to act as a Conservator over Fannie Mae and Freddie Mac.

Some banks were bailed out in trillions of dollars, but Retirees and Pension Plans got wiped out!

Fannie and Freddie almost 15 years into Conservatorship and Washington D.C. Congressional Members have turned a blind eye to “Stop the Steal” of Retirees Dividends. Thus, without Retirees investing their hard earned American dollars into Fannie and Freddie, neither corporations would exist.

Yet Fannie and Freddie continue to have their profits taken over by the government that includes dividends being swept into the U.S. Treasury coffer.

Former 2008 President Bush, used his leadership influence that has led a trickle-down effect into State Courts, by appointing Conservators over American’s. Many Americans then see their loved ones assets earned from hard work, blood sweat and tears, which is then eaten away from Conservator, Trustee, Lawyer Fees and other types of fees conjured up by courts.

Same Conservator’s who also do Takings overs one’s own assets and body, Retiree Savings, Checking Accounts & Pension Plans and with imposing excessive Conservatorship Fees, that has become nothing more than a license to steal ones hard earned assets often intended to be passed from one family generation to another.

“The Federal National Mortgage Association, Stock Ticker Symbol: (FNMA), typically known as Fannie Mae., was established to stimulate the housing market by making more mortgages available to moderate- to low-income borrowers.”

Fannie Mae Total Assets (Quarterly): 4.209T for Sept. 30, 2021 and Stock Price closed on 3/03/2022 at: $0.80

How does a company like Fannie Mae remain in Conservatorship, with reporting Sept 30, 2021, $4.209T Total Assets? More importantly, how does a company with $4.209T (Trillion), Total Assets and its stock only trades at $0.80?

Because FNMA has become so infused with artificial suppression of its stock by “Stock Gamblers,” who bet corporations to fail and its stock to fail.

Terminology Wall Street uses, but calls it: “Naked Shorting” FNMA Stock. “Naked Shorting,” to mean: “[t]he illegal practice of short selling shares that have not been affirmatively determined to exist. Ordinarily, traders must borrow a stock or determine that it can be borrowed before they sell it short.

So naked shorting refers to short pressure on a stock that may be larger than the tradable shares in the market. Despite being made illegal after the 2008–09 financial crisis, naked shorting continues to happen because of loopholes in rules and discrepancies between paper and electronic trading systems,” says Investopedia.

Did you also know that Fannie Mae Institutional investors were forced to selloff investment accounts because Fannie Mae stock dropped below $5.00, dollars? Thereby making Fannie Mae no longer qualified to trade on NYSE, only trading on OTCMKTS.

Imagine building a company from the ground up and successfully turning it into a multimillion dollar company of your dreams, but then the government decides it needs cash and takes over your corporation’s assets and profits without declaring a Nationwide Emergency.

U.S. Treasury and FHFA “Do the Right Thing,” release Fannie Mae and Freddie Mac, from Conservatorship, because 15 Years is long enough!

###

The thanks my husband and I get in giving back as blessed Christians, within the Antelope Valley Homeless Community, in Lancaster, CA

January 12, 2022, Wednesday

Moffatt Media, Palmdale, California

By: Moffatt Media Staff

Moffatt Media brings to you a Public Service Announcement

(“Rally Mask Mandates and Mandated Vaccine Passports”)

When: Today, 1/12/2022, Wednesday

Where: Palmdale, California – Front of City Council

Time: 6:00pm

Purpose: Rally Opposing – “Mask Mandates” and “Mandated Vaccine Passports” in the City of Palmdale, California

Take Action: Get involved with the Palmdale Freedom Coalition by Supporting this Rally. It is Time!

About Palmdale Freedom Coalition: “We believe that the government should not force vaccines or mask mandates on its citizens and that vaccine passports should be banned.” …

Today the City of Palmdale will vote whether or not to impose “Mask Mandates” and Mandated Vaccines.

###

Mark Brnovich said on Fox News in part moments ago: “Vaccine Mandates” are unconstitutional.”

https://video.foxnews.com/v/6290481125001#sp=show-clips

However, YOU Bronovich have turned a blind eye to an “unconstitutionally seated judge” seated on the Supreme Court bench from (2010-2021). The same “Unconstitutionally Seated Judge William J. O’Neil that adversely impacted constitutional rights of thousands of Arizona Lawyer’s.

Hopefully, the people will see your appearance on Fox News as nothing more than political rhetoric since now seeking a U.S. Senate seat.

In the past dozen years, state and local judges have repeatedly escaped public accountability for misdeeds that have victimized thousands. Nine of 10 kept their jobs, a Reuters investigation found – including an Alabama judge who unlawfully jailed hundreds of poor people, many of them Black, over traffic fines.

Filed

Judge Les Hayes once sentenced a single mother to 496 days behind bars for failing to pay traffic tickets. The sentence was so stiff it exceeded the jail time Alabama allows for negligent homicide.

Marquita Johnson, who was locked up in April 2012, says the impact of her time in jail endures today. Johnson’s three children were cast into foster care while she was incarcerated. One daughter was molested, state records show. Another was physically abused.

“Judge Hayes took away my life and didn’t care how my children suffered,” said Johnson, now 36. “My girls will never be the same.”

Fellow inmates found her sentence hard to believe. “They had a nickname for me: The Woman with All the Days,” Johnson said. “That’s what they called me: The Woman with All the Days. There were people who had committed real crimes who got out before me.”

[rml_read_more]

In 2016, the state agency that oversees judges charged Hayes with violating Alabama’s code of judicial conduct. According to the Judicial Inquiry Commission, Hayes broke state and federal laws by jailing Johnson and hundreds of other Montgomery residents too poor to pay fines. Among those jailed: a plumber struggling to make rent, a mother who skipped meals to cover the medical bills of her disabled son, and a hotel housekeeper working her way through college.

Hayes, a judge since 2000, admitted in court documents to violating 10 different parts of the state’s judicial conduct code. One of the counts was a breach of a judge’s most essential duty: failing to “respect and comply with the law.”

Despite the severity of the ruling, Hayes wasn’t barred from serving as a judge. Instead, the judicial commission and Hayes reached a deal. The former Eagle Scout would serve an 11-month unpaid suspension. Then he could return to the bench.

Until he was disciplined, Hayes said in an interview with Reuters, “I never thought I was doing something wrong.”

This week, Hayes is set to retire after 20 years as a judge. In a statement to Reuters, Hayes said he was “very remorseful” for his misdeeds.

Community activists say his departure is long overdue. Yet the decision to leave, they say, should never have been his to make, given his record of misconduct.

“He should have been fired years ago,” said Willie Knight, pastor of North Montgomery Baptist Church. “He broke the law and wanted to get away with it. His sudden retirement is years too late.”

Hayes is among thousands of state and local judges across America who were allowed to keep positions of extraordinary power and prestige after violating judicial ethics rules or breaking laws they pledged to uphold, a Reuters investigation found.

Judges have made racist statements, lied to state officials and forced defendants to languish in jail without a lawyer – and then returned to the bench, sometimes with little more than a rebuke from the state agencies overseeing their conduct.

Recent media reports have documented failures in judicial oversight in South Carolina, Louisiana and Illinois. Reuters went further.

In the first comprehensive accounting of judicial misconduct nationally, Reuters identified and reviewed 1,509 cases from the last dozen years – 2008 through 2019 – in which judges resigned, retired or were publicly disciplined following accusations of misconduct. In addition, reporters identified another 3,613 cases from 2008 through 2018 in which states disciplined wayward judges but kept hidden from the public key details of their offenses – including the identities of the judges themselves.

All told, 9 of every 10 judges were allowed to return to the bench after they were sanctioned for misconduct, Reuters determined. They included a California judge who had sex in his courthouse chambers, once with his former law intern and separately with an attorney; a New York judge who berated domestic violence victims; and a Maryland judge who, after his arrest for driving drunk, was allowed to return to the bench provided he took a Breathalyzer test before each appearance.

The news agency’s findings reveal an “excessively” forgiving judicial disciplinary system, said Stephen Gillers, a law professor at New York University who writes about judicial ethics. Although punishment short of removal from the bench is appropriate for most misconduct cases, Gillers said, the public “would be appalled at some of the lenient treatment judges get” for substantial transgressions.

Among the cases from the past year alone:

In Utah, a judge texted a video of a man’s scrotum to court clerks. He was reprimanded but remains on the bench.

In Indiana, three judges attending a conference last spring got drunk and sparked a 3 a.m. brawl outside a White Castle fast-food restaurant that ended with two of the judges shot. Although the state supreme court found the three judges had “discredited the entire Indiana judiciary,” each returned to the bench after a suspension.

In Texas, a judge burst in on jurors deliberating the case of a woman charged with sex trafficking and declared that God told him the defendant was innocent. The offending judge received a warning and returned to the bench. The defendant was convicted after a new judge took over the case.

“There are certain things where there should be a level of zero tolerance,” the jury foreman, Mark House, told Reuters. The judge should have been fined, House said, and kicked off the bench. “There is no justice, because he is still doing his job.”

Judicial misconduct specialists say such behavior has the potential to erode trust in America’s courts and, absent tough consequences, could give judges license to behave with impunity.

“When you see cases like that, the public starts to wonder about the integrity and honesty of the system,” said Steve Scheckman, a lawyer who directed Louisiana’s oversight agency and served as deputy director of New York’s. “It looks like a good ol’ boys club.”

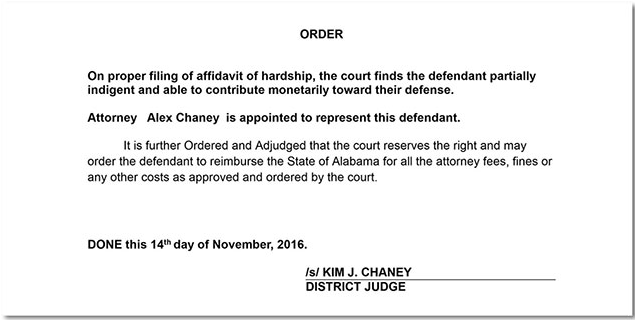

That’s how local lawyers viewed the case of a longtime Alabama judge who concurrently served on the state’s judicial oversight commission. The judge, Cullman District Court’s Kim Chaney, remained on the bench for three years after being accused of violating the same nepotism rules he was tasked with enforcing on the oversight commission. In at least 200 cases, court records show, Judge Chaney chose his own son to serve as a court-appointed defense lawyer for the indigent, enabling the younger Chaney to earn at least $105,000 in fees over two years.

In February, months after Reuters repeatedly asked Chaney and the state judicial commission about those cases, he retired from the bench as part of a deal with state authorities to end the investigation.

Tommy Drake, the lawyer who first filed a complaint against Chaney in 2016, said he doubts the judge would have been forced from the bench if Reuters hadn’t examined the case.

“You know the only reason they did anything about Chaney is because you guys started asking questions,” Drake said. “Otherwise, he’d still be there.”